This article first appeared in our International Women’s Day issue of My Green Pod Magazine, published 08 March 2024. Click here to subscribe to our digital edition and get each issue delivered straight to your inbox

According to the Climate Action Report, 85% of leading UK pension providers have ‘inadequate’ or ‘poor’ climate plans in place.

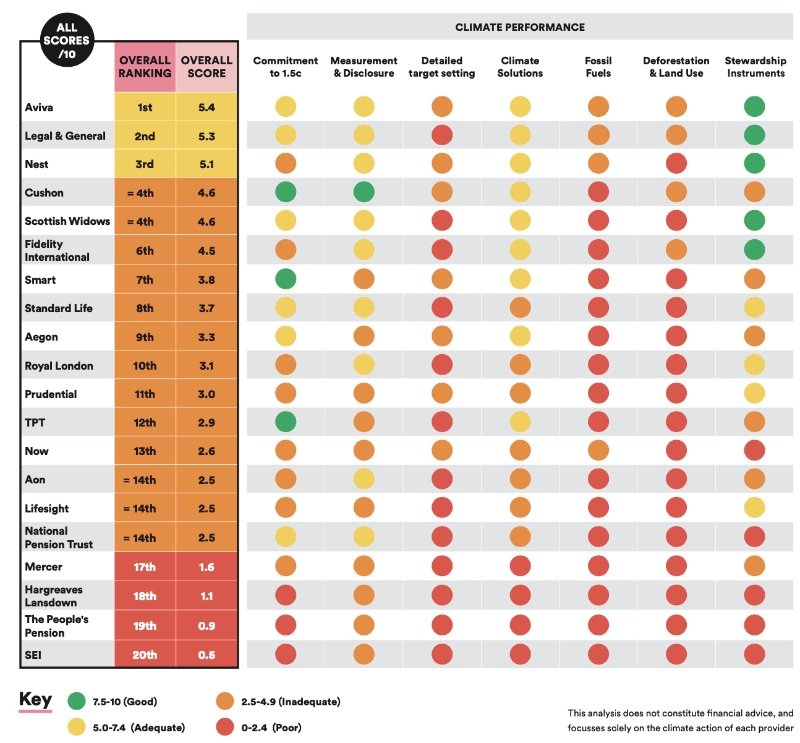

The new report assesses and ranks the climate strategies of the UK’s 20 largest Defined Contribution (DC) workplace providers, which collectively manage more than £500 billion in assets and have more than 15 million active members.

It was developed by sustainability research provider Profundo in partnership with green pensions campaign Make My Money Matter.

Lack of climate leadership

Almost all of the providers have public net zero targets, yet the ranking shows significant failings in detailed climate plans. Not one was deemed to be taking a leadership role on climate action.

Just three of the 20 – Aviva, Legal & General and Nest – were found to have ‘adequate’ plans in place.

13 providers – including household names Royal London, Prudential and Standard Life – have plans that are deemed ‘inadequate’.

The four worst-performing providers – Mercer, Hargreaves Lansdown, The People’s Pension and SEI – which manage the pensions of over 2 million UK savers, have ‘poor’ plans in place, scoring on average just one out of 10 for climate action.

‘Climate leadership is not just important for the planet – it’s popular, too’, said Richard Curtis, co-founder of Make My Money Matter. ‘But the fact that 17 of the UK’s top 20 providers have inadequate or poor climate plans tells you all you need to know about how seriously the industry is taking this issue.’

‘The public will rightly be worried about these results’, Richard continued, ‘and we hope this ranking acts as an urgent wake-up call for the pensions industry to up its game on climate change. They can help protect the planet and provide savers with pensions they can be proud of.’

Ranking pension providers

The first-of-its-kind analysis from Profundo reviewed the 20 providers’ publicly available climate documentation, and assessed the extent to which each has effective objectives, policies and instruments in place to respond to climate change and drive real-world impact.

Detailed analysis was undertaken on seven core indicators of climate action: a commitment to a 1.5ºC pathway, measurement and disclosure of carbon footprint, detailed target setting, investments in climate solutions, a phase-out of fossil fuels, deforestation and land use and portfolio stewardship instruments.

Providers were scored against criteria for each using internationally recognised standards.

Play Video about This Rock Might Just Save The World

Play Video about This Rock Might Just Save The World Play Video about Play 2 hours of rock

Play Video about Play 2 hours of rock Play Video about Play 2 hours of brook

Play Video about Play 2 hours of brook Play Video about Play 2 hours of sheep

Play Video about Play 2 hours of sheep